do nonprofits pay taxes in canada

Meals include amounts spent for food beverages taxes and related tips. File Your Taxes for Free.

Simple Ways To Start A Nonprofit In Canada With Pictures

Once you complete the online process you will receive immediate notification.

. Or in cash or by check or money order. To deduct your contribution to a Canadian charity you must generally have income from sources in Canada. 501c2 Title holding corporations for exempt organizations.

Reporting your tips to your employer using Form 4070. You can pay your taxes by making electronic payments online. Source income and is taxed according to the rules in chapter 4.

Be able to deduct contributions to certain Canadian charitable organizations covered under an income tax treaty with Canada. Accelerate mission impact increase innovation and optimize efficiencywith world-class security. E-file and pay by credit or debit card.

If you pay the entire cost of a health or accident insurance plan dont include any amounts you receive for your disability as income on your tax return. If your pay for these services is more than 3000 the entire amount is income from a trade or business within the United States. A court can sometimes act in the interest of justice and fairness to require one side to pay the attorneys fees.

Citizen or lawful permanent resident green card holder who is a resident of Canada the benefits are taxable only in Canada. If a judgment creditor doesnt renew a judgment on time then that judgment lapses. Apply for an Employer ID Number EIN.

Most individuals use the cash method of accounting. QSubs and eligible single-owner disregarded entities must pay and report excise taxes other than IRS Nos. Different to pure word-of-mouth strategies which are primarily customer directed with the company unable to track influence and measure message content.

For individuals and businesses. Up to 50 of the Social Security and Medicare taxes you owe on your unreported tips. If you pay more than fair market value to a.

When you prepare your federal tax return the IRS allows you to deduct the donations you make to churches. A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. 31 51 and 117 register for most excise tax activities and claim any refunds credits and payments under the entitys employer identification.

Charities and Nonprofits. Business calls while on your business trip. To report your tips to your employer youll need to fill out a Form 4070 Employees Report of Tips to Employer.

Hulu tries to ramp up virtual pay TV signups ahead of football season with tongue-in-cheek TV ads NextTV. This includes business communication by fax machine or other communication devices. Exemption Type IRC section Description.

859-320-3581 not toll free. As a cash basis taxpayer you generally deduct your rental expenses in the year you pay them. This is an international transaction and the final price is subject to exchange rates and the inclusion of IOF taxes.

Federal State and Local Governments. Referral marketing encourages and rewards. Government Hardship Grants Government hardship grants provide you fast cash free government money for individuals government hardship grants for individuals Personal Financial Hardship Grants Most forms of Help for Home the medical bills Or other expenses like debt relief will come from Associations or government assistance programs.

In general you must report the interest in income in the taxable year in which you redeemed the bonds to the extent you did not include the interest in income in a prior taxable year. Line 15 special rates and conditions. Avoid a penalty by filing and paying your tax by the due date even if you cant pay what you owe.

So a creditor cant. Up to 48 of transportation-related businesses could not afford to pay their rent in July. By Daniel Frankel published 24 August 22.

You typically wont pay taxes on gifts received through international money transfers but youll need to report it using Form 3520. If the recipient is a US. Courts have significant discretion when it comes to the awarding of attorneys fees and while judges do not generally like departing from the American Rule they might require a losing side to pay the others attorneys fees in certain limited situations.

Apply online for a payment plan including installment agreement to pay off your balance over time. Dry cleaning and laundry. Refer to Tax Topic 423 Social Security and Equivalent Railroad Retirement Benefits for information about determining the taxable amount of your benefits.

According to the same study rent struggles are also prominent for trucking companies and car services. You will need to provide certain information from your tax return for 2020. Peacock Touts 199-a-Month Fall Promo Takes Over Next-Day Access to All NBC and Bravo Series Starting September 19.

If you wish to make a payment by electronic funds withdrawal see the instructions for Form 4868. This is due by the 10th of the month and it covers the previous. A judgment may also lapse if the creditor doesnt do anything to execute on that judgment for a certain period.

From a mobile device using the IRS2Go app. You might have to pay taxes on transfers you receive if they were income including capital gains. When a judgment lapses or becomes dormant the creditor can no longer legally enforce it.

The instructions for this line have been updated to include representations required by entities claiming treaty benefits on business profits or gains not attributable to a permanent establishment including for a foreign partner that derives gain subject to tax under section 864c8 upon the transfer of an interest in a partnership and that would. Referral marketing is a word-of-mouth initiative designed by a company to incentivize existing customers to introduce their family friends and contacts to become new customers. See Meals later for additional rules and limits.

Paying electronically is quick easy and faster than mailing in a check or money order. In most years as long as you itemize your deductions you can generally claim 100 percent of your church donations as a deduction. Federal State and Local Governments.

501c3 Religious educational charitable scientific literary testing for public safety fostering national or international amateur sports competition or prevention of cruelty to children or animals organizations. You must to pay taxes on gifts you send if youve given more than 1158 million in your lifetime. To meet your tax obligation in monthly installments if you cant pay your taxes in full today.

If you e-file Form 4868 do not also send a paper Form 4868 unless you also mail a check or money order for your tax payment. Tips you pay for any expenses in this. An eNF will not be issued.

If you use an accrual method you generally report income when you earn it rather than when you receive it and you deduct your expenses when you incur them rather than when you pay them. Nonprofits are also rapidly collapsing with 44 unable to. If your church operates solely for religious and educational purposes your donation will qualify for the tax deduction.

If you pay the premiums of a health or accident insurance plan through a cafeteria plan and you didnt include the amount of the premium as taxable income to you the premiums are considered. Not reporting also puts you at risk for a penalty. If you do not meet all three conditions your income from personal services performed in the United States is US.

Non Profit Vs Not For Profit What S The Difference 2022

Accounting And Bookkeeping For Non Profit Organizations Npo Green Quarter Consulting Surrey Bc

A Nonprofit Guide To Human Resources Management

5 Steps To Running Payroll In Canada Payroll Payroll Template Canada Pension Plan

Sources And Uses Of Incomes In The Nonprofit Sector

Canadian Nonprofits Make Tax Receipts Compliant With Canada Revenue Agency S Regulations Nonprofit Blog

Sources And Uses Of Incomes In The Nonprofit Sector

Community And Non Profit Jobs In Canada Moving To Canada

![]()

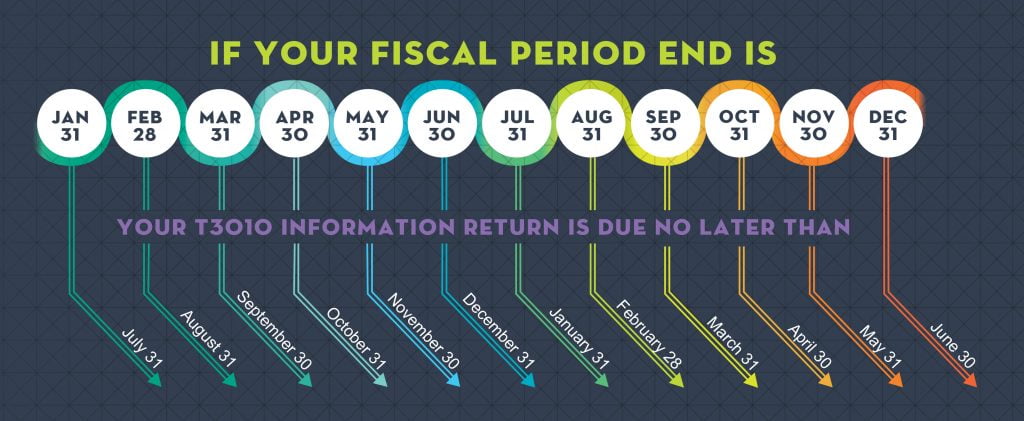

Canadian Tax Requirements For Nonprofits Charitable Organizations

Graphic Design Hacks For Nonprofits Online Tools Design Hack Non Profit

Infographic On Charitable Giving In Canada From Imagine Canada Http Www Imaginecanada Ca Node 802 Infographic N Charitable Giving Infographic Charitable

![]()

Guide To Gst Hst Information For Nonprofit Organizations Enkel